Budget Commission Special Meeting – January 18, 2024

Meeting Details: The Geauga County Budget Commission met in Special Session on Thursday, January 18, 2024 at 10:00 am in the Auditor’s Conference Room at 215 Main Street, Chardon, Ohio. This meeting was in person with a virtual option via MS Teams.

Meeting Attendance: Auditor Chuck Walder, Prosecutor Jim Flaiz, and Chief Deputy Treasurer Caroline Mansfield (substituting for Treasurer Chris Hitchcock).

Staff Attendance: Deputy Auditors Tammy Most and Kristen Sinatra and Fiscal Office Manager Pam McMahan.

County Staff: Geauga County Budget and Finance Manager Adrian Gorton (virtual).

Others in Attendance: This observer (virtual).

The meeting was called to order at 10:00am.

Minutes: Minutes from the Special Meeting on January 3, 2024 were approved.

The following Revenue Certifications were approved:

Observer Note: The Budget Commission requests that all entities provide beginning balances for all funds within 90 days of the start of the year. Most of the following amendments are simply certifications of fund beginning balances for 2024.

-

Geauga County Public Library (GCPL) - Amendment # 1. $13,616,414.56 in the general fund, $1,790,505.11 in debt service funds, and $13,572,351.88 in capital project funds for a total of $28,979,271.55.

This amendment certified GCPL’s beginning balances for 2024.

-

City of Chardon - Amendment #1. $12,382,050.82 in the general fund, $9,478,294.21 in special revenue funds, $372,412.54 in debt service funds, $7,347,052.18 in capital project funds, $7,395,737.57 in enterprise funds, $8,054.18 in internal service funds, and $186,201.12 in fiduciary funds for a total of $37,169,802.62.

This amendment certified the City of Chardon’s carryover balances and some additional (not specified) revenue. Mr. Walder said that the City of Chardon has “a lot of money,” and Mr. Flaiz noted Chardon has about $30 million even when enterprise funds are not considered.

-

Burton Township - Amendment #1. $774,153.14 in the general fund and $1,897,483.36 in special revenue funds for a total of $2,671,636.50.

This amendment certified Burton Township’s beginning balances for 2024. Ms. Sinatra noted that this amendment was the last submission from Burton Township’s Fiscal Officer Shelley McDermott, as she is moving on to a new position as Treasurer of Shaker Heights Schools. It was stated that Burton Township has a replacement for Ms. McDermott, but the name of the replacement was not mentioned.

This amendment certified Thompson Township Park’s beginning balance for 2024.

-

Chester Township - Amendment #1. $3,123,738.19 in the general fund, $11,217,201.64 in special revenue funds, $5,032.00 in capital project funds, and $13,011.99 in special assessment funds for a total of $14,358,983.82.

This amendment certified Chester Township’s beginning balances for 2024.

-

Berkshire Local Schools - Amendment #5. $22,815,132.75 in the general fund, $3,835,676.44 in special revenue funds, $1,438,469.49 in debt service funds, $1,032,836.59 in capital project funds, $849,134.62 in enterprise funds, $481,168.08 in internal service funds, and $178,821.32 in fiduciary funds for a total of $30,631,239.29.

Berkshire’s amendment certified increases in their student activities and school safety special revenue funds.

Other Business:

Mr. Walder also proposed allowing public comment before the Budget Commission votes on each school budget as opposed to waiting until the end of the meeting when the votes have already taken place as has been done in the past. He stated that “a hearing is the public's only time to weigh in on a school or an entity's use of public monies” and further noted that “I think the public is more in tune now than they've ever been with the percentage of their taxes that are going to schools, and they have a right to ask the question, and I think we owe it to them to hear it.”

Mr. Walder went on to express concern about how the school districts’ spending might change due to receiving unexpected increases in revenue from the inside millage windfall (all Geauga school districts) as well as 20 mill floor adjustments (Berkshire and West G only). He opined that “Your spending habits grow to meet your revenue. Well that's not how we should be doing this. And that's my worry. Once they get this money, are they just going to inflate expenditures to meet the revenue? They have to explain that if that's true.… Historical tracking is going to become really important for us. If their expenses jump dramatically because they got this windfall that they don't want to call a windfall, then they have to explain why this happened.”

The Budget Commissioners decided to allow public comment before the vote on each school budget, and it was noted that if this procedure goes well, it may be applied to all Budget Commission hearings going forward. The Budget Commissioners opted not to set a time limit on public comments but stated that they would require commenters to stay on topic.

Mr. Flaiz said his office would prepare slides for the School Budget Hearings with information about what the law says regarding school budgets and what the Budget Commission’s role is in examining budgets. He noted that there is an Ohio Supreme Court ruling stating that County Budget Commissions cannot allow local school districts to receive increased tax dollars from residents without demonstrating that the money was clearly required by the schools. Mr. Walder said that the function of a Budget Commission “... is not to determine what you spend your money on. It’s to be sure that when you take the money from the taxpayer, that you do use it, that stockpiling is not one of the options of choice, and my worry is growing when I’m seeing $90 million of unencumbered cash (among Geauga’s five school districts).”

The Budget Commissioners wrapped up their discussion on the School Budget Hearings by deciding that the hearings would be 30 minutes in length per school district, though running over on time would be allowed if necessary. Mr. Walder said that School Board Members and Superintendents are encouraged to attend the School Budget Hearings in addition to the Treasurers that usually attend.

-

Mr. Walder and Mr. Flaiz discussed the effect on property taxes when residents of a given school district live in counties with different property reappraisal years. Last year Geauga County property values were reappraised and increased dramatically, while property values in Cuyahoga County were not reassessed. This will cause the amount of taxes Geauga residents of Chagrin School District must pay to the district to increase this year, while the amount Cuyahoga residents of Chagrin Schools must pay to the district will decrease. Mr. Walder explained this is because the total amount of property taxes that a school district is owed is divided up based on property values. Since Geauga’s values went up and Cuyahoga’s values did not, Geauga residents of Chagrin Schools will pay a higher proportion of the total tax owed to the district than Cuyahoga residents; due to this, Mr. Walder estimated that the amount of South Russell residents’ total property taxes going to schools has jumped from 56% to 70%. This problem will correct itself next year once Cuyahoga County’s revaluation is completed and takes effect, but for this year Geauga residents living the the Chagrin School District will have an increased tax burden.

Public Comment:

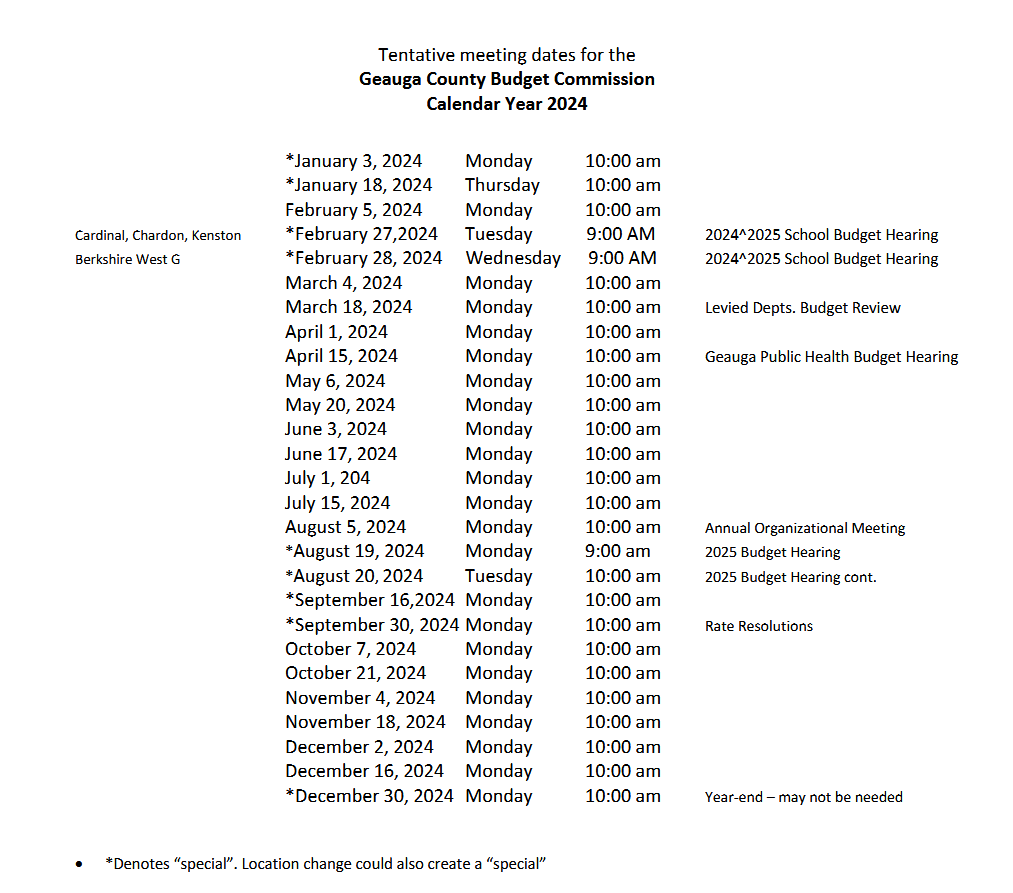

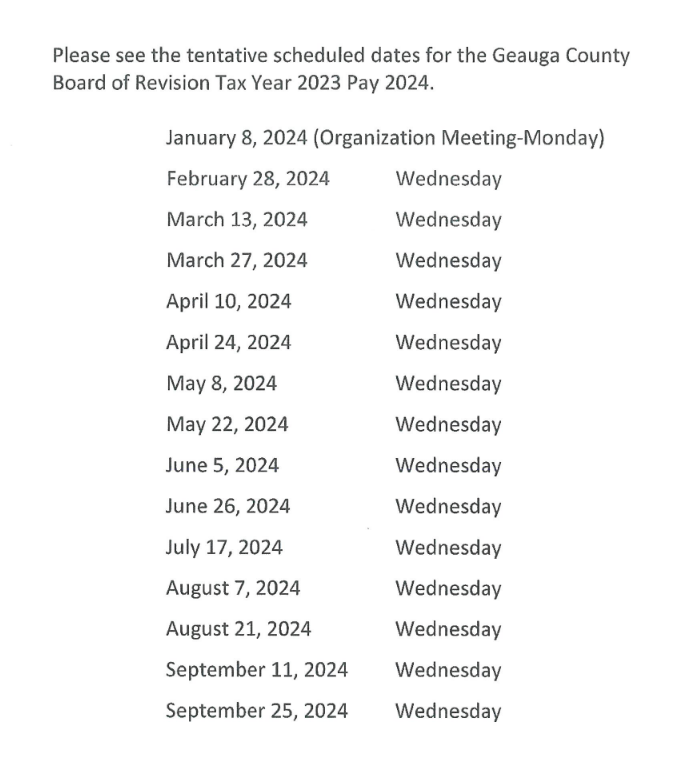

This observer requested copies of the approved Revenue Certifications as well as a copy of the Budget Commission and Board of Revision (BOR) meeting schedules for 2024. The names of all meeting attendees were confirmed.

Observer Note: The 2024 BOR meeting schedule was emailed to this observer and is listed below.

The meeting was adjourned at 10:48 am.

More Information and Posted Minutes: Available on Auditor website

Next Meeting: February 5, 2024 at 10:00 am in the Auditor’s Conference Room at 215 Main Street, Chardon, Ohio.

Observer: Sarah McGlone

Editor: Anne Ondrey

Reviewer: Gail Roussey

Submitted 1/19/24

The League of Women Voters of Geauga is a 501(c)(3) nonpartisan political organization that encourages informed and active participation in government, works to increase understanding of major public policy issues, and influences public policy through education and advocacy. They do not support or oppose individual candidates or parties. Learn more about the LWVG at www.lwvgeauga.org.