Budget Commission Hearings for 2023 Budgets

Meetings started at 9 am on Monday August 15th and continued Tuesday, August 16th until 1:05 pm at The Appraisal Conference Room in Chardon.

Members present were as follows: Chris Hitchcock (Treasurer) – except for the second half of the Monday hearing when the Treasurer’s designee, Caroline Mansfield was present.; Chuck Walder (Auditor), except for the Russell Twp meeting when Chief Deputy Auditor Ron Leyde represented Mr. Walder, and Mr. James Flaiz (Prosecutor).

Also present were: Tammy Most (Deputy Auditor), Kristen Sinatra (Deputy Auditor), Kate Jacob McClain, Chief Compliance Officer, Pam McMahon, Administrative Assistant, Frank Antenucci (ADP) overseeing the virtual hearings. For the Geauga Park District meeting, Attorney Kristen Rine from the Prosecutor’s office was also present.

Budget Hearings Description: 32 entities presented their budgets in 15-minute scheduled time slots and included 16 townships, 4 villages, 1 city, 2 library systems, 4 township parks, 1 recreation system, 1 fire district, 1 solid waste district, 1 county park system and the County Commissioners.

All hearings convened on schedule. The only one that went longer than the allotted time was the last one, Geauga Park District. Notably, this was the only budget submission that was not approved.

These hearings were held in the Appraisal conference room. Virtual attendance was available via Web-ex. A remote viewing room was also provided. There were no issues with the virtual attendance except it was sometimes difficult to hear the reading of the budget numbers. These should appear on Budget Commission minutes when posted (as they did last year).

For each entity the Auditor projected on screen a list of items to review. One item that was recurring was Schedule A and B and Publication of Budget Hearing.

Observer Note: this Observer asked, after the first day of hearings, whether the Schedule A and B and the notice of Public Hearing on Budget were required as these were listed for each entity and for a few (such as Auburn Township) they had not been provided. The Auditor stated that they are not required but for Schedule A and B they facilitate the process for the Budget Commission and the copy of the Public Hearing is a good reminder for these entities but also not required by the Budget Commission.

The other items read as submitted included cash reserves, expenses and amount to be certified. In addition, items reported included any special funds, such as Fire, Road and Bridge, etc. The total tax millage was reported for each. All of these figures will be available in the published minutes of the Budget Commission and are only noted here if there was discussion and/or questions.

ORC 5705.29 (see: https://codes.ohio.gov/ohio-revised-code/section-5705.29) lists the budget requirements including the provision to provide two previous budgets in the presentation and detailed amounts of cash carryover, revenue and expenses for the prior two years. The Budget Commissioner looked at the anticipated cash carryover for the end of the year to determine if there were sufficient funds to provide salaries and other operating expenses until the first quarter property tax payment in March. They also reviewed whether there was an excess amount of cash.

One issue that came up with some of the fire departments is that they are actually run by private contractors, so the municipality only pays a set contract fee and doesn't necessarily have access to the budget details. Mr. Walder stated that his office does not have authority to review those budgets, and it was the consensus of the Budget Commission that the State auditor's office wasn't able to audit these private contractors either. This came up with Burton Village and the East Geauga Fire Dept (Middlefield). Also Mr. Hitchcock brought up the idea of consolidating the fire departments regionally, as has been done with East Geauga Fire in Middlefield into a Fire District.

HEARING NOTES: MONDAY – AUGUST 16

Thompson Twp. - Approved.

Thompson Park District - Approved.

Bainbridge Township - Approved.

Troy Twp. - Approved.

Chardon Twp. - Question about Roads and Bridges fund as to whether there will be enough cash at the end of year to meet payroll in January. Recognitions that ARPA funds could supplement. Approved.

Burton Twp. – Discussion about Burton Fire District as the private Fire Department owns the equipment that was purchased with taxpayer funds. It was reported that the Fire Department does not want to explore the idea of forming a Fire District. Approved.

Montville Twp. – Noted that the budget is very tight, ending cash balance too low, Fire and EMS ending balance too low but if levy (.2 mil Fire) is approved they should be okay. Question about how the ARPA funds were reported was resolved. Approved.

Claridon Twp. – Approved, question about the Taylor Wells paving; told that it would be the first project in 2023. Another question about how ARPA funds were reported and stated to make sure the funds are put in the correct budget year. Approved.

Parkman Twp. – insufficient ending cash balance. Question about the reporting of Covid money. The paperwork was lost and the money received is in jeopardy due to lost paperwork. There was a change in fiscal officer. The Township will work with the Prosecutor’s office to see if they can properly re-create this paperwork since there was a resolution reflected in the minutes. Approved.

Chester Twp. – Township is running tight. It was stated that they will need to cut back on expenses or use ARPA to solve some of the issues. They are the second largest in County. Have several funds including Road and Bridge, Police and Reserve fund. The Road and Bridge fund is high due to bids coming in over the 10% bid specs. Approved.

At this point Caroline Mansfield was representing Mr. Hitchcock for the rest of the day.

Hambden Twp. Two of the funds, Roads and Bridges and Park, were too low on cash carryover into 2023. Another question about whether the ARPA funds were correctly entered. They did receive both of their payments. Approved.

Observer Note: Most entities seem to have received their ARPA funds in two segments in 2022.

Munson Twp. – excellent work by finance director Todd Ray. It was noted that Mr. Ray had successfully moved Munson out of zero-based budgeting, which is hard to do but is a better system of accounting. Approved.

Mr. Walder exited the hearing, replaced by Mr. Ron Leyde, Deputy Auditor. Mr. Walder had previously done work for Russell Township.

Russell Twp. – They have several funds: Roads and Bridges, Fire, Police and Reserve Fund accounts.

There was a discussion about potential projects that will be paid out of the Reserve Fund. The funds previously allocated to the storage shed renovation will be used for other projects due to the fact that they needed more input from EPA. One of the Trustees said that the Reserve Funds will be used for renovations to the Town Hall. Mr. Flaiz stated that it was a good thing that the Fire levy was removed from the ballot. He stated that they will take a look at the Reserve Funds next year, as this money is supposed to be spent for the purpose stated when the Reserve was created. Approved.

Mr. Walder returned to the hearing.

Newbury Twp. – Some comments about Kiwanis Lake. Approved.

Huntsburg Twp. – Approved.

Middlefield Twp. – Question about the fund that they used for ARPA, typically use 2073 and 2074, but Middlefield used 2904 and should look into this. There was also a question about using the wrong line item in the Ambulance Fund. Noted that there were several renewal levies on the ballot. Approved.

Auburn Township – Noted no Schedule A and B, no proof of Public Meeting on Budget

Several funds, two were off but were corrected: Roads and Bridges, Fire, ARPA. Stated that there was a negative cash balance in the Roads and Bridges funds. There is a levy (which should pass). The Budget Commission has the authority and will reduce expenses to show a positive cash balance. If the levy doesn’t pass, they will have to do this anyway. Approved.

Geauga/Trumbull Solid Waste District - There was discussion about the new recycling center in Chardon and what a great facility this is for the County. The Budget Commission stated that they appreciated the good working relationship. Approved.

Geauga County – Budget Commission stated that they would like to see more information. They are still near zero-based budgeting. It was stated that there had been reductions in Job and Family Services (JFS) funding through a suspension of .5 mil levy as well as a reduction in the Mental Health and Recovery Board levy from .5 to .25. Mr. Walder stated that it is really hard to get out of zero-based budgeting. It was stated by Adrian that some other requests had been deferred (or denied) such as Board of Election ($435,000), ADP ($904,000) and Sheriffs Department ($668,000 divided into three years). Mr. Flaiz said that with a $10 Million carryover it didn’t appear that they really needed to deny the above requests.

Mr. Adrian Gorton, Finance Director for the County Commissioners, stated that this year was the highest ever sales tax revenue and that property tax and casino tax funds went up. He didn’t anticipate that level again next year.

It was stated that for the 2021 budget they had been off by $9 million. Approved.

HEARING NOTES: TUESDAY – AUGUST 16

Russell 1545 Park - Approved.

Chester Park – General Fund $7,733 - Approved.

Russell Citizens Park – Approved.

Geauga Library - Gen fund – $3.31 million, Debt service fund $617,596, Bldg & repair fund $330,970, Cap. Improvement fund – $5,757,730. Two reserve funds were created as requested last year. Miller Dodson Study reviewed all assets that need to be maintained. This includes a building on Chardon Square. They will do a study to see if they can do an addition to this building. Cash balance has been creeping up, but stated by the Library that it’s for the Chardon Sq. building. Approved.

City of Chardon - General fund – $1,264,519; Police levy – $19,325; Fire & ambulance – $518,637; Police Pension $15,472. Approved.

Burton Village General fund – $411,055; Fire fund $1,029; Police fund $118,596; Road improvement $91,149. Approved.

Aquilla Village General fund – $78,834; Road fund $10,397; Fire & EMS $0. The Commissioners questioned whether the $1,500 budgeted for road maintenance would be enough. Approved.

Burton Library- General fund – $265,137. Approved.

West Geauga Rec. No Schedule A or B Stated that it was well done. Discussion about Newbury, which is now part of the district, but there had been no discussions about services to Newbury. Approved

Middlefield Village – No Schedule A or B but stated they will submit later. Praise for an excellent submission. Several funds: Police Fund and Ambulance Fund (1.45 renewal levy) Total of 6.45 mils. Approved.

East Geauga Fire District is one of the few Fire Districts in the County serving Huntsburg, Middlefield Twp and Village. Treasurer praised this model and said he hoped it would be used elsewhere in the County. Confirmed that they received no donations. Approved.

South Russell Village - Budget Commission noted budget submission well done with Schedule A & B. They also have a police fund, a Road and Bridge Fund and 2 reserve funds. There was a discussion of the cost to repair or replace the Salt Dome, which could be substantial. Approved.

Geauga Park District

This was a long and contentious hearing that lasted 1-1/2 hours (as opposed to the typical 10-15 minutes). Those attending were all three regular Budget Commissioners, and from the Park District, Director John Oros, Finance Director Jennifer Pae, Commissioners Howard Bates and Jolene Carnabuci, Deputy Director Matt McCue, and John Slagter from Tucker Ellis (the Park Commissioner’s attorney).

Topic #1 - Accuracy of Submission: The Geauga Park District stated they were using a UAN accounting system (favored by the Budget Commission), but that the actual budget submission was on an excel spreadsheet. Mr. Walder expressed dismay with this arrangement since each cell of an excel spreadsheet can be manually changed. Outputting the UAN gives an accurate result of the results of the UAN system.

The Budget Commission reviewed the submission, including the Land Improvement fund, Capital Improvement Fund, Canine Fund and a newly created Reserve Fund. The ending balance in the General Fund was presented as $425,484.

Upon being questioned about using the excel spreadsheets, Ms. Pae stated that ORC did not require UAN.

Mr. Walder stated that she was correct, but then the Budget Commission would need to somehow independently verify the amounts. He stated that they did this last year and found the large discrepancy which led to the withholding of levy funds of $1.9 million.

Ms. Pae further stated that she had supplied two years of actual budgets as required and that the State Auditor was in the middle of an audit. She also referenced another private auditing company that had performed an audit last year and stated that the numbers reflected the result of that audit.

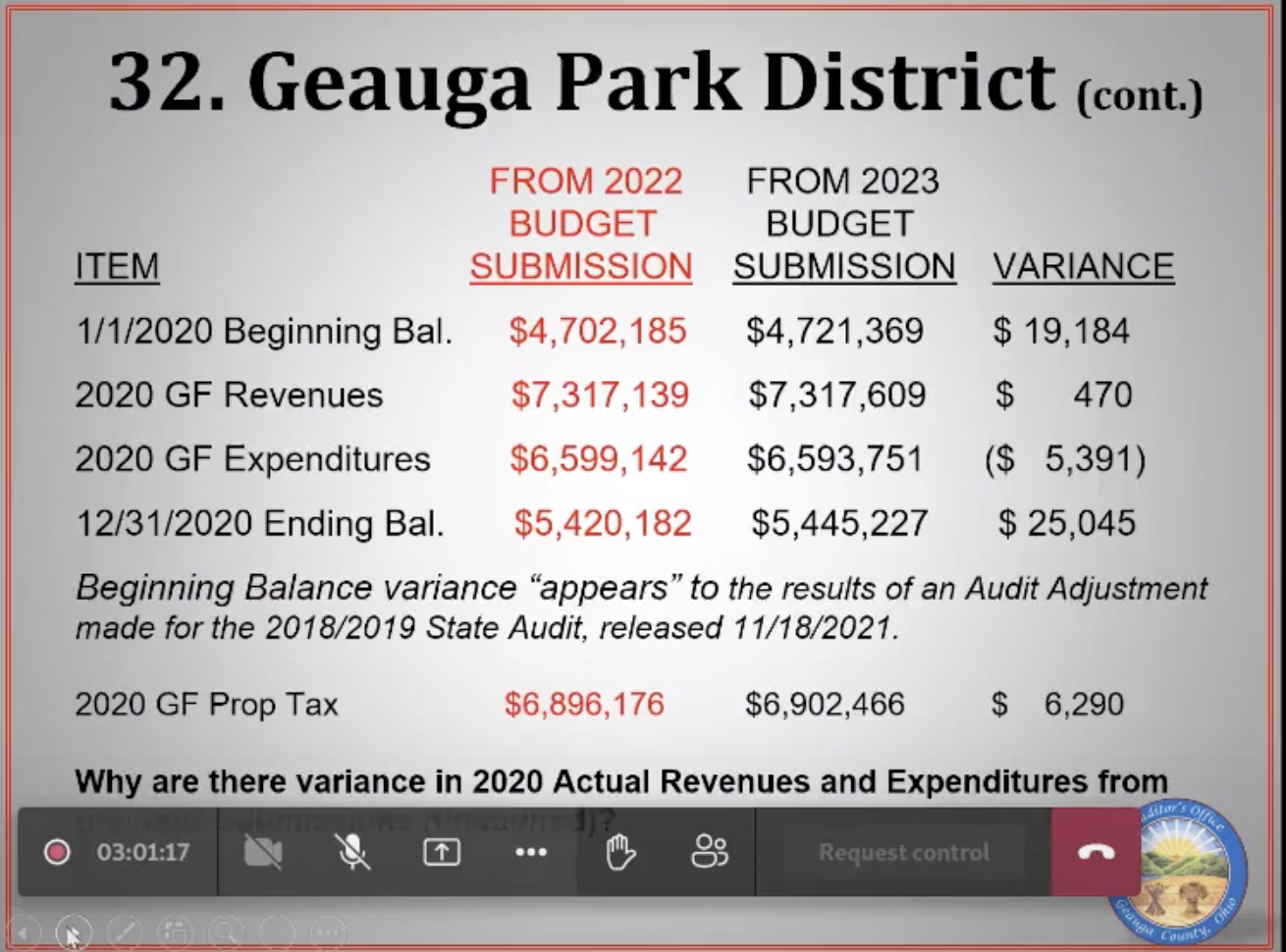

Discussion turned to multiple discrepancies between the 2020 data submitted in 2022 (in red, left column) vs the 2020 data that was submitted for 2023 (in black, right column). Per the Budget Commission, the figures in these two columns should be the same. Refer below to screenshot of image shared on screen during meeting:

Furthermore, Mr. Walder asserted that the Park District’s submission erroneously stated the 2020 General Fund Property Tax received was $6,902,466. Walder stated that Treasurer Hitchcock collected $6,896,176 and that he, as Auditor, distributed that amount to the Geauga Park District (red column,

above). He questioned how the disbursement from his office to the Geauga Park District could have changed from one budget submission to the next.

Ms. Pae explained that her number came from the incomplete State Audit and from their private Audit. When Mr. Walder and Mr. Hitchcock rejected that explanation, she expressed frustration that her office was not provided these details prior to the meeting and that no one had responded to their public records request.

Ms. Pae: What tax budget are we here for today?

Mr. Walder: 2023.

Ms. Pae: That’s correct. So why are we arguing about 2020?

Mr. Walder: Because the numbers have to balance…

Ms. Pae: Where in the statute does it say we have to…

Mr. Walder: It says you have to give accurate numbers.

Mr. Flaiz concurred, stating “these numbers are provided by you” and further, that the actual numbers are required.

Mr. Slagter, counsel for GPD, referred to a letter from the Budget Commission dated Feb 7, 2022 that indicated they would be notified of any issues through Form GCA-020, which would be sent to them one week ahead of their hearing. Mr. Slagter asserted they received Form GCA-020 only on the previous Thursday, that numerous attempts were made to communicate, that a public records request was sent on Friday, August 12 and that no one responded to them. Many people suddenly talking at once:

Mr. Walder: We don’t give people worksheets before the hearing.

Mr. Flaiz: You act like this is some kind of ambush.

Mr. Slagter: It is an ambush!

Mr. Flaiz: How are we ambushing you with your own numbers?

Mr. Flaiz reminded GPD that this was the Budget Commission’s hearing and stated they had not received any phone calls.

Kristen Rine, attorney from the Prosecutor’s Office, stated that she had responded that it was under legal review.

Mr. Walder indicated that the reason no one had responded to the public records request was because it was received Friday, August 12 at 4pm and hearings for the other 31 public bodies began Monday August 15 at 9am. Mr. Walder also implied the request was overly broad, saying that GPD had requested “any and all work materials related to the Geauga Parks District.”

Mr. Slagter continued to rail against the Commission, questioning why they were not just picking up the phone and calling to work this out. Mr. Walder said he had an answer to that question, and referred to an email he had indicating that on Thursday, Aug 11 at 10:35am, Ms. Pae communicated with 20+ individuals addressing the Form GCA-020 received from the Budget Commission. Per Mr. Walder, Ms. Pae characterized the Budget Commissions concerns as “all nonsense and here’s why.” He further asserted that Ms. Pae did not have a lack of understanding - in her mind - of what the issues were. He then proceeded to read the email aloud into the record.

Reviewer Comment: As noted in our Observer Corps Report for the August 15, 2022 Geauga Park District Board Meeting, Jennifer Pae included LWVG in an August 11, 2022 email thread that addressed submission issues listed in Budget Commission form letter GCA-020, which was dated August 8, 2022. The recipient list for that email, which included numerous supporting documents, was sent to board members, staff leadership, numerous attorneys, a CPA and 8 different individuals at the Ohio Auditor’s office.

Mr. Slagter interrupted the recitation, and a great deal of hair-splitting back and forth about audited vs. actual numbers ensued. Ms. Pae stated she didn’t need to produce audited numbers and Mr. Flaiz and Mr. Walder again stated that there should be no dispute about the actual number of what was paid by the County to the Park last year.

Mr. Slagter inquired, “What is the legal issue?”

Ms. Pae, after again explaining the numbers were provided by their outside accountant, inquired whether a six thousand dollar potential variance on a six million dollar budget statutorily impacts the tax budget.

Ms. Pae then said she was not the fiscal officer last year and was seeing the reported prior year 2020 figures for the first time. The Budget Commission members were incredulous that she had not reviewed the prior year submission.

Mr. Slagter asked where to go from here and Mr. Walder indicated they should move on.

Topic #2 - New Reserve Fund: The Geauga Park District created a new Reserve Fund which the Budget Commission believes to be fatally flawed and unsupported by law. Per Ms. Pae, GPD worked with counsel to establish the reserve fund under ORC 5705.13(c).

Mr. Walder cited the requirements of ORC 5705.13(c) which require that there must be a stated maximum in the creating resolution, as well as a term. The term of such a Reserve fund should begin when the Resolution is passed appropriately by the Board. Further issues had to do with the Purpose clause which does not list purchase of property, which is what the Board actually intended to use the Fund to do. Mr. Walder opined, “You have to create it lawfully…you can’t just make up the rules.”

Mr. Slagter stated that oversight for this fund falls under the State Auditor and questioned who had determined the fund was unlawful. Mr. Flaiz indicated Ms. Rine made the determination, and Mr. Slagter proceeded to question the validity of the decision. Mr. Flaiz said that “any lawyer that could read the statute” would see the requirements were not met.

Mr. Slagter again opined that the State Auditor would determine legality and complained that they were just hearing about this issue for the first time today. Mr. Walder pointed out the inaccuracy of that statement by referring to the August 11 email where Ms. Pae specifically stated the reserve fund was lawfully created. Mr. Slagter responded, “we have no decision that it’s not…”

As further indication that Geauga Park District was aware of potential flaws with the reserve fund, Mr. Walder stated that when GPD sent the Resolution to the Budget Commission to certify it, the Budget Commission identified concerns and sent the request to the prosecutor’s office for a legal opinion. This was relayed to GPD.

Mr. Walder: …the Budget Commission cannot certify funds into an account that was not lawfully created…

Mr. Flaiz: It would likely be a crime.

Mr. Slagter expressed their intention to comply with the law then continued to complain they had not received proper notice of the issues prior to the meeting.

Mr. Walder further explained that the revenue stream used was not a viable one to fund a Reserve Fund since there would be no way to refund the money if the Reserve Fund was closed. The actual way to fund such a Reserve Fund would have been to deposit the funds in the General Fund and then to transfer them to the Reserve Fund. He also noted that the purpose noted in the resolution was not consistent with the minutes provided.

Mr. Flaiz stated that in addition to the fatal flaws in the Resolution, according to ORC 5705.13(c) the Geauga Park District had no authority to create such a fund since they are not a taxing unit.

Mr. Walder offered 3 resources to aid the Geauga Park District in properly creating a reserve fund.

Mr. Flaiz further stated that even though the Budget Commission had not certified monies to the reserve fund, GPD had appropriated funds and spent some of those funds. Ms. Pae stated funds had been appropriated but not spent. Mr. Walder pointed to the minutes, which indicate $279,000 was spent to purchase property. Mr. Oros stated the minutes indicate they were to enter into negotiations to purchase but that no purchase had been made.

Observer Note: From the July 18, 2022 Geauga Park District Minutes: No executive session. Mr. Preston asked for an update on the tax board. Ms. Pae said they would be submitting by July 20, 2022, meeting internally and then the budget hearing is August 16, 2022. Mr. Bates asked if the August meeting should be held after the 8/16/22 budget commission meeting. Mr. Hicks, legal counsel, stated a special meeting could be called if necessary. Mr. Bates asked about the land acquisition fund and Ms. Pae said they had not approved the land acquisition fund as of now. Ms. Pae explained the park district is required by Ohio Revised Code to get certification from the county auditor, but looking at the state of Ohio auditor, if a decision or response is not received from the Auditor, the Park can still spend the funds as appropriated by the board. Mr. Oros said we are going to move forward on the current property acquisition…

Mr. Walder discussed a “reasonableness test” that asked whether the public or the Budget Commission would find it reasonable to set aside $1.3 million in a reserve fund while members of the Board publicly claimed operations were “crippled” by the $1.9 million prior year reduction in tax revenue. Mr. Slagter again questioned whether it was under the Budget Commission’s purview to determine whether the reserve fund should be established.

Mr. Slagter expressed a need to “get past this” and in the next breath suggested political issues were a factor…Mr. Walder countered that much of the issues could have been avoided if they were a more transparent organization. He admonished them for not allowing public comment in their meetings. Mr. Slagter countered that they are not required to do so, which Mr. Walder acknowledged.

Mr. Walder and Mr. Flaiz said GPD had no right to complain about being barraged with questions as they are basically unaccountable to the public and these hearings are the one opportunity each year to ask them questions.

Ms. Pae again claimed “we didn’t know what the issues were.” Mr. Walder and Mr. Flaiz informed her that previous Budget Commission meetings were recorded and broadcast and that they discussed the reserve fund in open session during meetings that were summarized by the League of Women Voters. They pointed out they also allow public comments at their meetings and answer some tough questions.

Reviewer note: See discussions in the Budget Commission Observer Reports for June 29, July 7 and August 1, 2022. Ms. Pae’s August 11, 2022 email included the July 7, 2022 Observer Report as an attachment.

Mr. Walder stated that the Budget Commission could amend the budget as submitted, but there seemed to be agreement between all three Budget Commissioners that the Land Acquisition Fund had fatal flaws.

Mr. Slagter requested time to address the issues before a final decision is made.

Recommended Action: Mr. Hitchcock expressed his desire to immediately cut 1.3 million from the funds allocated to the Geauga Park District due to his frustration that the Geauga Park District was unable to properly account for the money they received or demonstrate need with accurate figures.

Mr. Hitchcock chastised Mr. Oros for presenting numbers that don’t balance, saying it was embarrassing for him and for his organization. He also took issue with Ms. Pae’s comments that suggested a $6,900 variance was inconsequential, noting that it was a lot of money to a lot of people. He again focused his ire on Mr. Oros for not permitting public comment. Mr. Oros responded that he is not responsible for that decision as he answers to the Board. Mr. Hitchcock admonished him to lead.

Mr. Flaiz felt the bad legal advice given regarding the reserve fund was a mitigating factor and Mr. Walder felt the parties needed to cool down and work through the issues. Their more measured response prevailed and a meeting was scheduled for the very last day possible before budget submissions had to be complete – Wednesday, August 31 at 9 am. It was acknowledged that most of the people in the room would need to be at the Geauga County Fair before the ribbon cutting for the 200th Anniversary at noon that day.

Public Comment: Dave Partington of Protect Geauga Parks (a non-profit not affiliated with the Geauga Park District) stated that he had sent a certified letter to Ms. Pae in early July informing her of the reserve fund issues. He did not receive a response from her. At this point the Geauga Park District attorney and members and staff were not in the hearing room so there was no response to this comment.

More Information and Minutes of past Budget Commission meetings

Next Meeting: August 31, 2022 at 9 am

Name of Observers: Aimee Gilman, Nina Lalich, Gail Roussey

Name of Reviewer: Shelly Lewis

Submitted 8/20/2022

The League of Women Voters of Geauga is a 501(c)(3) nonpartisan political organization that encourages informed and active participation in government, works to increase understanding of major public policy issues, and influences public policy through education and advocacy. They do not support or oppose individual candidates or parties. Learn more about the LWVG at www.lwvgeauga.org.